Personal Finance

What your net worth statement is telling you

Use our free spreadsheet to get a summary of all your assets and liabilities, This snapshot is a crucial first step toward getting a better handle on your finances.

Mentioned:

Compiling a net worth statement might seem like a tedious task. But it’s also one of the best ways to get a clear snapshot of your financial health.

In this article, I’ll walk through a hypothetical net worth statement and discuss how to interpret what it’s telling you.

Complete a net worth statement

To put together a net worth spreadsheet, you can find many free templates online to use as a starting point. You can also use Morningstar's printable PDF statement template for Australian households.

Alternatively, you are able to download a spreadsheet if you prefer to use a digital version.

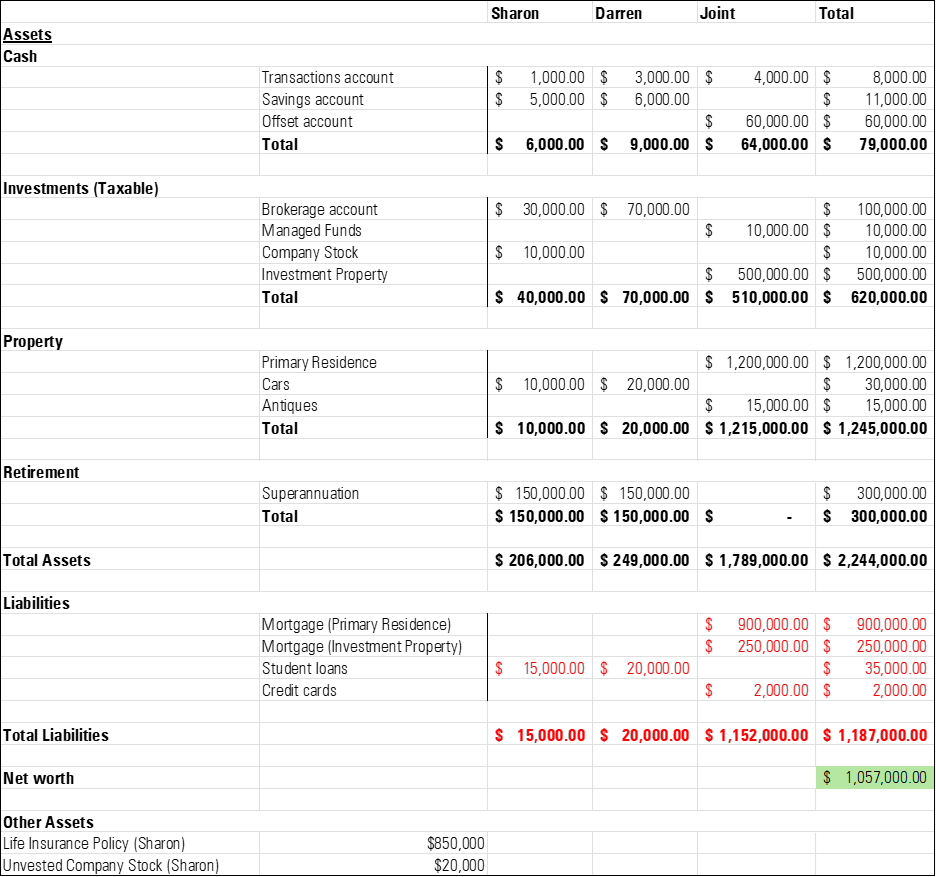

In this example, the net worth statement below is based on a fictional Australian couple, Sharon and Darren.

What your net worth statement is telling you

Let's break down the ins-and-outs of what this statement is showing.

Overall net worth (assets minus liabilities)

From a big-picture perspective, the ultimate insight from a net worth statement is exactly what it says: the net worth number, which is simply assets minus liabilities.

The number in isolation doesn't tell you too much, but it is a useful benchmark to track over time.

A negative net worth figure would obviously indicate room for improvement.

Debt to income ratio

To calculate your debt ratio, you'll need to add up all required monthly debt payments, including mortgage payments, personal and car loans, and credit card debt. Then take the total and divide it by your monthly gross (pretax) income.

Lower is obviously better for this number, and any number greater than 43% will likely create problems in obtaining or refinancing a mortgage.

Sharon and Darren have a fair amount of debt, so focusing on paying off loans with higher interest rates will free up more cash flow that they can funnel toward other goals, such as retirement. In this instance, it’s likely that they should focus on the credit card debt first as it will be a higher rate than the mortgage.

We discuss what's considered to be a good debt-to-income ratio in more detail here.

Emergency fund

Most financial advisers recommend keeping at least three to six months' worth of monthly living expenses in cash or other low-risk, highly liquid assets to cover a sudden job loss or other unforeseen events, such as car repairs, appliance replacement, or other home repairs.

Some investors may want to keep closer to 12 months' worth of expenses in cash if variable pay makes up a significant portion of their total compensation. The most common scenario is if you are a contractor or self-employed.

With about $79,000 in total cash assets, Sharon and Darren are in decent shape here, depending on their mortgage repayments and living expenses. They could focus on bolstering cash assets to further their peace of mind.

Single-company risk

If any one stock accounts for a large share of your net worth, that might be cause for concern. We’re not able to see in this example what the brokerage account holds, but it’s important to take a look into this when you are assessing net worth.

That's particularly true in the case of employee share schemes, because it means that your human capital (your ability to generate income and earn a living) and financial capital both depend on the fortunes of one company.

Sharon’s only has $10,000 employer stock, but if this number is larger, it represents a risk because it concentrates the couple’s financial assets.

The most conservative approach is to sell off employer stock until it consumes a smaller percentage of your total assets, although that usually means paying taxes on realised capital gains. If Sharon is early on in her career, the employer stock could make up less of her total net worth as she starts to build and contribute to other assets. This would help with holding onto the investments in the long-term and with the tax consequences.

Liquidity and valuation issues

For most assets, valuation is straightforward. But things get a bit trickier for collectibles, such as antiques.

The couple could consult an appraiser, especially if they plan to sell these assets at some point in the future.

Sharon and Darren should make sure all of these assets are securely stored and itemised on their homeowners' insurance policy.

Why your net worth statement matters

A net worth statement doesn’t tell you everything you need to know about your financial situation.

For example, Sharon and Darren would need to do more analysis to figure out if they’re on track for future obligations, such as funding their retirement. My colleague Mark LaMonica has written about how to calculate how much you need for retirement, and how to get there here.

But a net worth statement is a crucial starting point to get a better handle on your current financial picture.

Armed with this number, you can consider the following questions:

- Is your net worth in the red or just barely positive?

- How does your net worth compare with what it was at this time last year?

- How does your current debt load compare with what it was a year ago?

- Are all of your assets adequately insured?

- If you're getting close to retirement, is your current net worth on track to supply you with the living expenses you need, in addition to whatever you'll receive from a pension?

Why you need context

Net worth is important to understand, but ultimately it is a snapshot of your financial position and is almost always theoretical. It is comparable to a balance sheet of a company.

Many of the assets, excluding cash, are theoretically worth what they are listed for. There are often costs associated with disposing of assets (especially property) – as well as taxes. Values can also move around, some are more volatile than others. The snapshot that you’re looking at isn’t always representative of what you would have if you liquidated your assets.

Ultimately, it also does not determine your standard of living. You could be living in a $5 million dollar house and have $10,000 in savings. Alongside a net worth statement it is important to also look at a cashflow statement. This will look at your incoming payments and outgoing expenses, and give you an idea of the surplus or deficit that you’re running at. It is just one part of the comprehensive reviews of an individual’s financial situation to get a thorough understanding of their current standing, and to make informed decisions for the future.