Stocks

This moated ASX stock is swimming in cash

This cash cow has a fortress balance sheet and is undervalued according to our analyst.

Would you rather own a company that has lots of debt, or lots of excess cash? There are nuances to answering that question.

Companies with dependable profits can benefit from carrying debt because it can help the firm grow faster than it could otherwise. So as long as the company uses debt in moderation and can generate returns over and above the cost of that debt, it can be a prudent course of action.

I would be hard pushed, though, to ever see the absence of debt as a glaring negative. Perhaps the best way to think about some advantages of a cash rich balance sheet is to think about the downsides of the opposite situation – having too much debt.

For one, a debt laden balance sheet makes you more vulnerable. If business softens for any reason, interest obligations can suddenly take up a big slug of the remaining profits. And if things get really bad, the company may need to dilute shareholders (or wipe them out altogether) to meet their obligations.

The shadow of a big debt load can also reduce a management team’s flexibility to invest in projects that create long-term value for shareholders. Investments in research and development ("R&D") and marketing are easy “costs” to cut if you are worried about the debt pile or covering your next interest payment.

On a related note, a hefty debt load also makes it harder to turn industry downturns to your advantage. Investing with a long-term mindset while competitors fret over the next 3 months becomes difficult. As do other potentially accretive moves like acquiring a competitor at a depressed valuation, or repurchasing the company's shares at a big discount.

In theory, companies with a comfortable net cash position shouldn’t have those constraints.

Sure, a big net cash position may not be “optimal” capital structure given the company's industry or profitability. The company may even get the occasional spray from analysts for running a “lazy balance sheet”. But such a position does afford some comfort and, more importantly, provides elements of flexibility and optionality.

Having a clean balance sheet can also serve as a magnet to events that unlock value. Potential acquirers might prefer debt-free companies because they can borrow more to buy it. Or an activist investor might come in and push for the cash to be paid out or funneled to buybacks.

Short-term “wins” like this aren’t always the best long-term outcome for shareholders, but they may increase the chances of a profitable investment.

A cash rich category queen

Today’s article takes a look at The a2 Milk Co A2M.

Most dairy cows produce milk that contains both a1 and a2 proteins. However, in recent years consumers have flocked to dairy products that only contain a2 proteins amid perceived (but never really proven) health benefits.

The a2 Milk Co has been a prime beneficiary of this shift as its brand became synonymous with the broader category. a2 now accounts for around 11% of Australia’s fresh milk sales and is also home to Australia's leading infant formula brand through a2 Platinum.

The company has also grown its share of the much larger Chinese infant formula market to around 7%. These market share gains have come despite a2's generally premium pricing, which suggests that consumers are willing to pay up for the brand.

To put it mildly, a2 has a significant amount of net cash on its balance sheet. What’s more, our analyst Angus Hewitt thinks the company has an economic moat and is undervalued at the current share price.

But before we go any further – a quick reminder that individual shares and investments should only be considered as part of a deliberate investing strategy.If you don’t have your strategy nailed down yet, go here for a step-by-step guide to crafting one.

a2 Milk’s huge cash haul

a2 Milk has a market value of $4 billion and around $900 million in net cash. This means that an outright buyer at a price of $4 billion would, in theory, be paying just $3.1 billion for the operating business underneath and have access to that cash. A2’s big cash position is largely a result of two things.

Number one, a2 does not produce its own milk. Instead, it contracts with local dairy farmers or third-party producers. In Australia, fresh milk is processed at a2-owned sites. But elsewhere it is sourced and produced by third parties like Synlait, of which a2 owns around 20%.

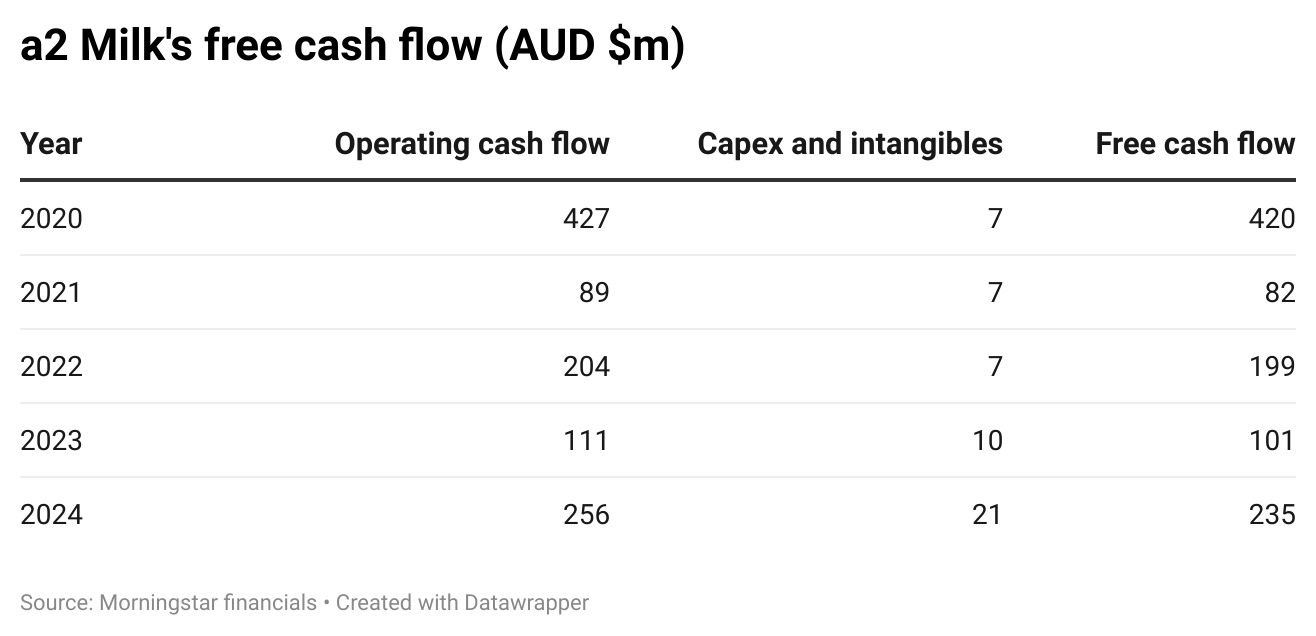

As a result, a2 is mostly a marketing and sales company, and has the minimal capital expenditure requirements to match. As a result, the business throws off a lot of free cash flow. Here are a2's operating cash flows, investments in equipment and intangible assets, and free cash flow (the difference between those two numbers) for the past five years.

Figure 1: a2 Milk's minimal capex requirements. Source: Morningstar

The second big contributor to A2’s huge net cash balance is how it has allocated capital to date.

Capital allocation describes how management decides to spend cash thrown off by a company. The main options for management are to distribute some of the cash to shareholders through dividends or buybacks, invest it in the existing business, use it to buy or invest in other businesses, or pay down debt.

In the past five years, you can see that A2 has generated a total of about $1 billion in free cash flow. Let’s look at how that has been split between the main capital allocation options from 2020-2024.

- a2 has not paid any cash out in dividends

- It has spent around $175 million on share repurchases

- It bought a 75% interest in Mataura Valley Milk for around $200 million in 2021

- It has paid off around $80m in debt

Added together, those uses of cash fall far below the $1 billion generated in free cash flow over that period. Add this to the $460m in cash they had at the start of the period and you get a huge net cash position today. The question, then, is what a2 might do with it.

Our a2 analyst Angus Hewitt thinks it is likely that a2 will start paying a dividend to shareholders at some point, but this could still be a couple of years off.

In the meantime, he thinks it is most likely that a2 will invest some of its cash to nurse the Mataura Valley business to profitability and some of it to support growth in its most important market – China.

China remains vital for a2’s growth prospects

a2 has been in the news recently after its 2024 results, which were released in August, disappointed investors. The numbers themselves were solid, with net profits up by 8%. But investors were spooked by the company's management team providing weak forward guidance.

This stemmed largely from production issues at key supplier Synlait, which produces a2 branded products for the key Australian and Chinese markets. For the China bound shipments, a2 had to foot the far higher cost of air freight to make up for delays in production.

The company forecast mid-single digit revenue growth in fiscal 2025 with margins suffering from a short-term reliance on air-freight. The majority owned Mataura Valley business also looks set to reach profitability later than expected.

Hewitt expects that a2 can average annual sales growth of around 8% over the next five years and grow earnings at a double-digit clip over that time. Most of this growth is set to come from China. While low birth rates look likely to stunt growth in the country’s infant formula market, Hewitt thinks a2 can continue to take market share and benefit from a willingness to pay up for its brand.

Shares look cheap but not without risks

Angus Hewitt thinks a2 Milk shares are worth $7.20 per share in Australian dollars. This is almost 30% higher than a2's current share price of $5.60, but he points out several risk factors that investors must consider.

Although a2 clearly has a strong brand in China and is making headway in the country, brands owned by much larger companies such as Nestle, Mead Johnson and Danone could offer stiff competition. If these companies throw their immense resources behind bigger marketing campaigns, for example, a2’s chances of capturing significant share in China could fall.

a2 is also dependent on consumers continuing to believe in the relative health benefits of dairy products lacking in a-1 proteins. Studies looking for major health benefits have been inconclusive so far, and any evidence to the contrary could hurt growth in the category.

Hewitt’s research has also noted a2’s dependence on a small number of suppliers, something that has been underlined by the impact of disrupted production at Synlait. Hewitt thinks this setback – which you could say contributed to August's fall in share price – could present an opportunity for long-term investors.

More equity investing articles:

- Lessons from Nick Sleep's famous investing letters

- Mark LaMonica explains why he is an income investor

- Five famous quotes and the lessons for investors

Get more Morningstar insights in your inbox

Terms used in this article

Star Rating: Our one- to five-star ratings are guideposts to a broad audience and individuals must consider their own specific investment goals, risk tolerance, and several other factors. A five-star rating means our analysts think the current market price likely represents an excessively pessimistic outlook and that beyond fair risk-adjusted returns are likely over a long timeframe. A one-star rating means our analysts think the market is pricing in an excessively optimistic outlook, limiting upside potential and leaving the investor exposed to capital loss.

Fair Value: Morningstar’s Fair Value estimate results from a detailed projection of a company's future cash flows, resulting from our analysts' independent primary research. Price To Fair Value measures the current market price against estimated Fair Value. If a company’s stock trades at $100 and our analysts believe it is worth $200, the price to fair value ratio would be 0.5. A Price to Fair Value over 1 suggests the share is overvalued.

Moat Rating: An economic moat is a structural feature that allows a firm to sustain excess profits over a long period. Companies with a narrow moat are those we believe are more likely than not to sustain excess returns for at least a decade. For wide-moat companies, we have high confidence that excess returns will persist for 10 years and are likely to persist at least 20 years. To learn more about how to identify companies with an economic moat, read this article by Mark LaMonica.

Uncertainty Rating: Morningstar’s Uncertainty Rating is designed to capture the range of potential outcomes for a company. An investor can think of this as the underlying risk of the business. For higher risk businesses with wider ranges of potential outcomes an investor should consider a larger margin of safety or difference between the estimate of what a share is worth and how much an investor pays. This rating is used to assign the margin of safety required before investing, which in turn explicitly drives our stock star rating system. The Uncertainty Rating is aimed at identifying the confidence we should have in assigning a fair value estimate for a stock. Read more about business risk and margin of safety here.